jersey city property tax calculator

Ad Enter Any Address Receive a Comprehensive Property Report. Jersey City establishes tax levies all within the states statutory rules.

31 Castleton Drive Backyard Castleton New Builds

By Mail - Check or money.

. Tax amount varies by county. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Find All The Record Information You Need Here.

Online Inquiry Payment. Online Inquiry Payment. Box 2025 Jersey City NJ 07303.

There is also an exemption threshold. Your employer uses the information that you provided on your W-4 form to. The average effective property tax rate in New Jersey is 242 compared to.

Federal income taxes are also withheld from each of your paychecks. Stay up to date on vaccine information. In Person - The Tax Collectors office is open 830 am.

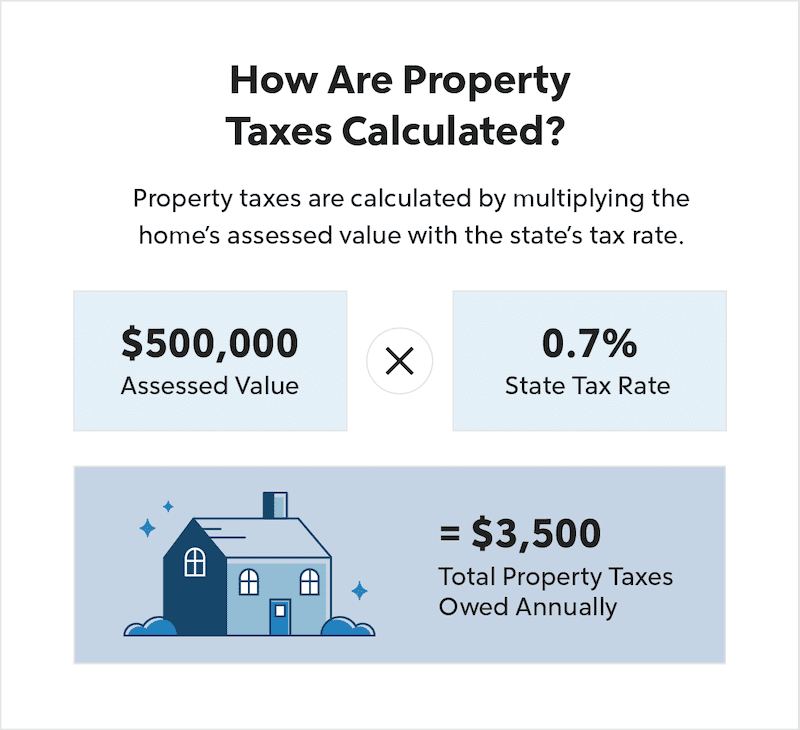

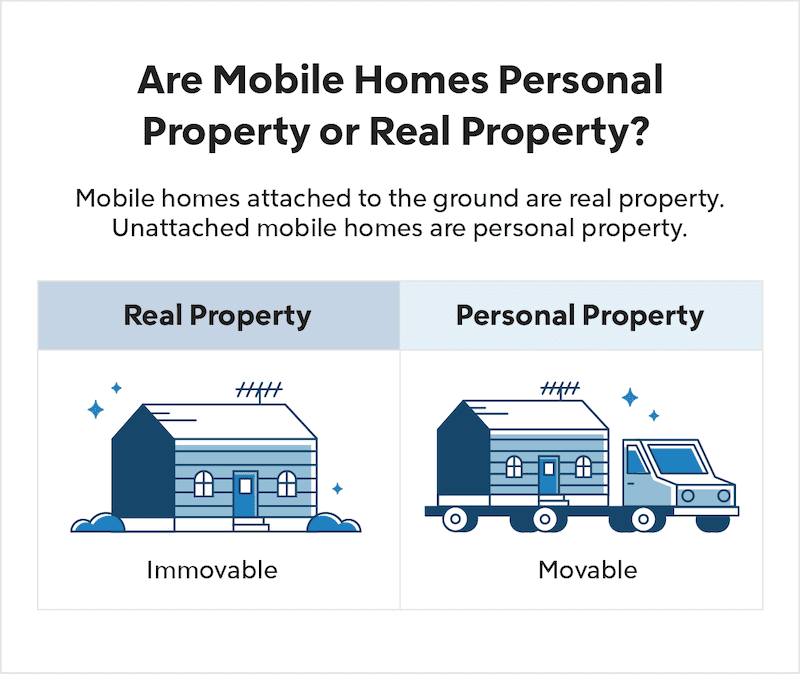

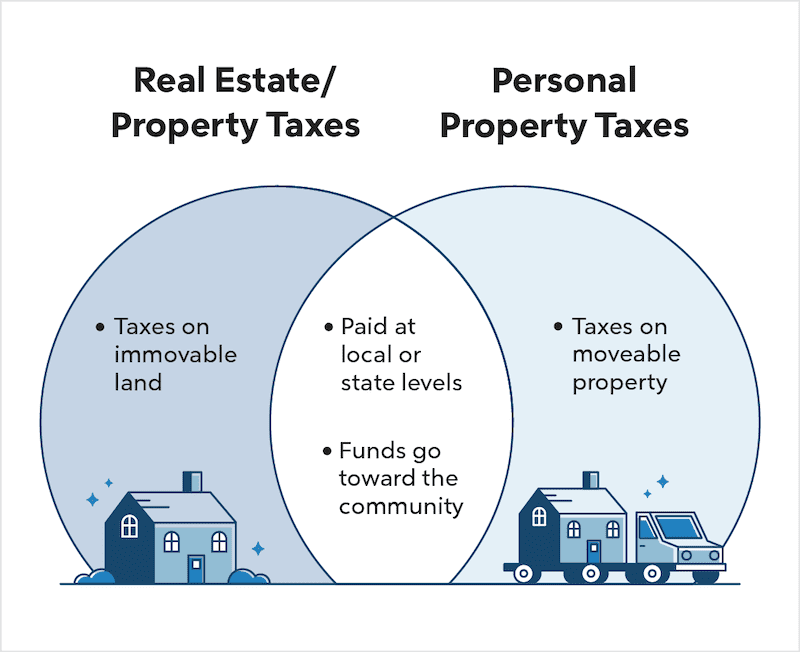

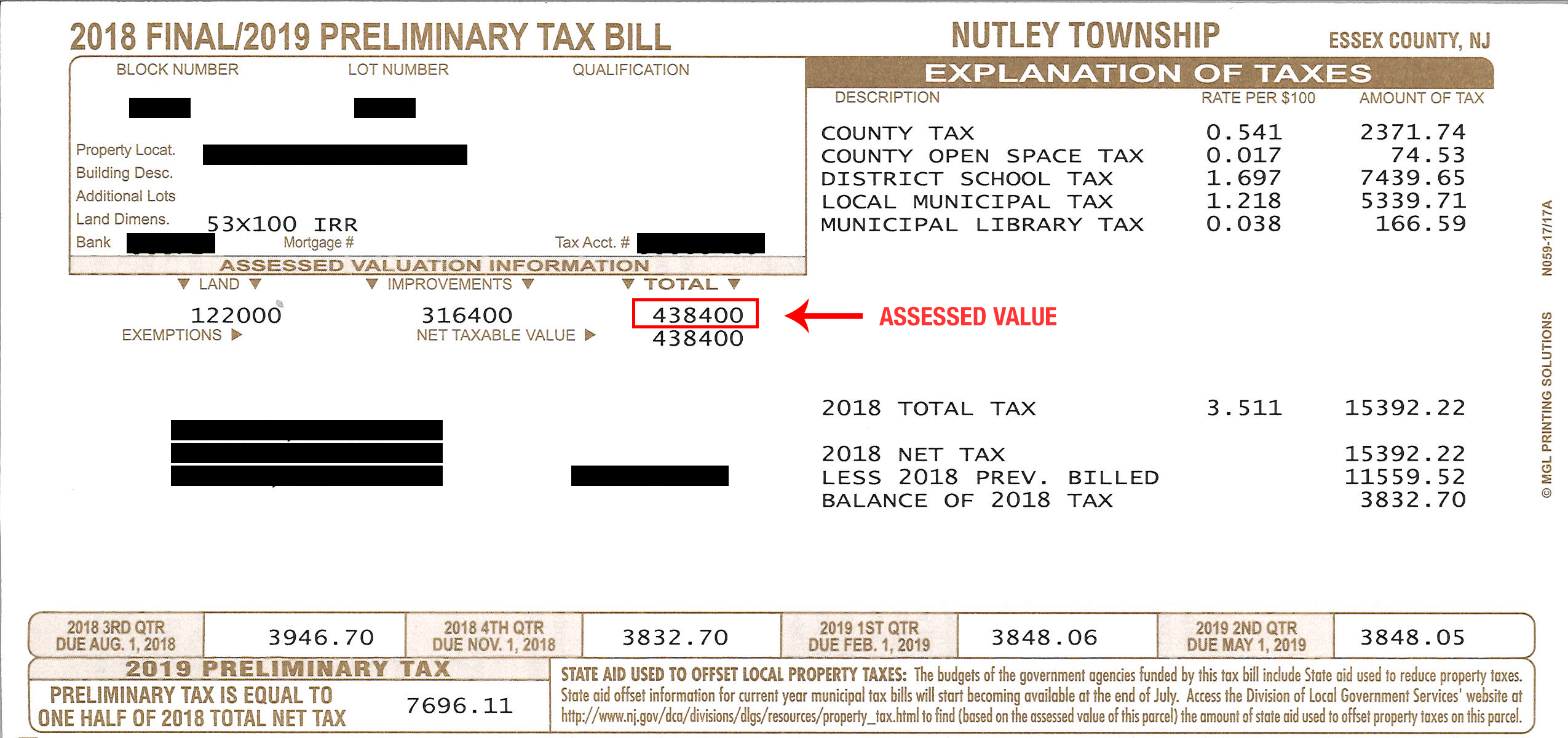

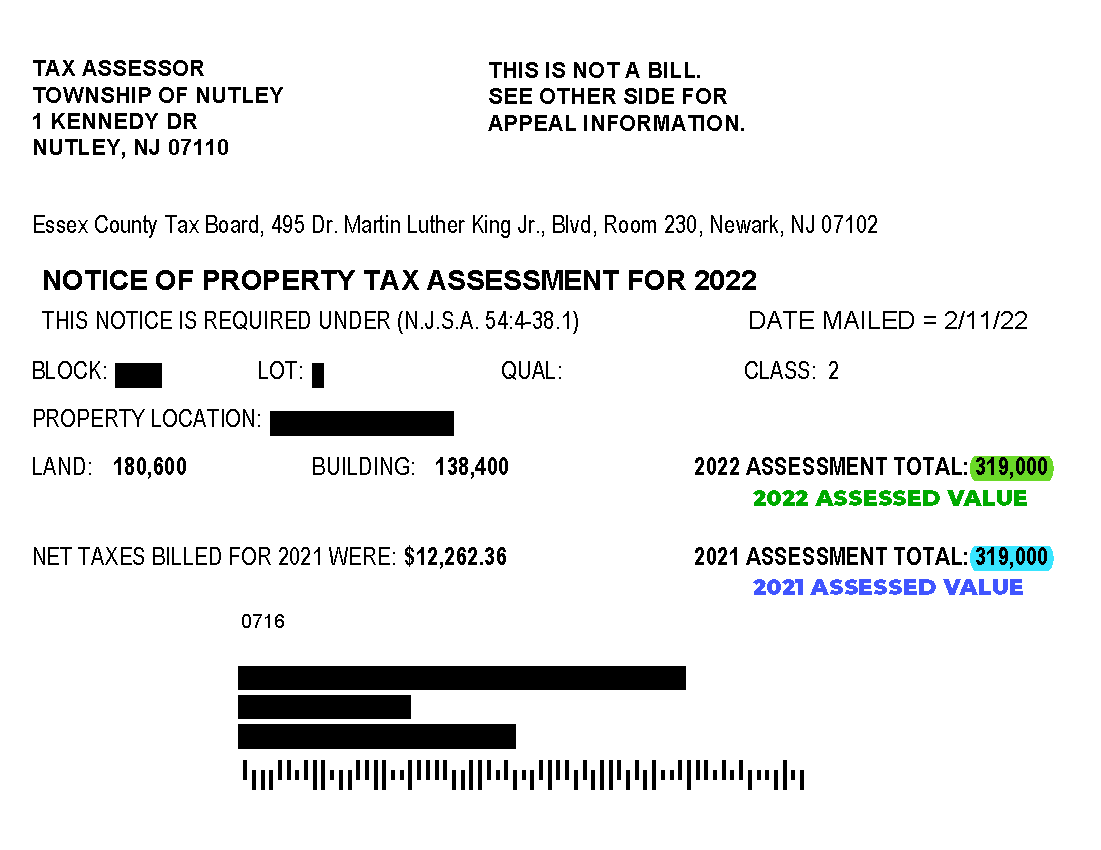

To view Jersey City Tax Rates and Ratios read more here. A towns general tax rate is calculated by dividing. New Jerseys real property tax is an ad valorem tax or a tax according to value.

Unsure Of The Value Of Your Property. How Your New Jersey Paycheck Works. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Use this calculator to estimate your NJ property tax bill. City of Jersey City. COVID-19 is still active.

For comparison the median home value in Jersey County is. City of Jersey City. The calculator will show you the.

Office of the City Assessor. 189 of home value. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

For comparison the median home value in New Jersey is. TO VIEW PROPERTY TAX ASSESSMENTS. HOW TO PAY PROPERTY TAXES.

Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving. For comparison the median home value in. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON.

See Results in Minutes. All real property is assessed according to the same standard. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON.

General Property Tax Information. Jersey city property tax. The total amount of property tax to be collected by a town is determined by its county municipal and school budget costs.

Calculation of income tax. Your yearly tax is calculated based on your total taxable income in the year less any deductions you can claim. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Jersey City NJ 07302. Property Tax Calculator - Estimate Any Homes Property Tax.

Real Estate Taxes Vs Property Taxes Quicken Loans

State Local Property Tax Collections Per Capita Tax Foundation

Property Tax How To Calculate Local Considerations

Nyc Home Prices Plunge After Salt Deductions Capped

Property Tax Calculator Casaplorer

14 Self Storage Marketing Ideas Marketing Ideas Storage And Cube Storage

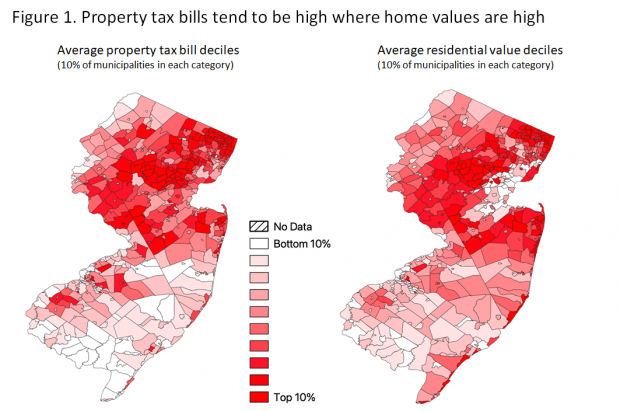

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Real Estate Taxes Vs Property Taxes Quicken Loans

Township Of Nutley New Jersey Property Tax Calculator

Property Tax Comparison By State For Cross State Businesses

Pin By Tu On Buildings Home Design Software Home Design Software Free House Exterior

2022 Property Taxes By State Report Propertyshark

New York Property Tax Calculator 2020 Empire Center For Public Policy

Township Of Nutley New Jersey Property Tax Calculator

Real Estate Blog Community For Professionals Activerain Single Story Homes Level Homes Home Buying